Bitcoin miners are the backbone of the Bitcoin network. They validate and secure transactions on the blockchain and produce Bitcoin at a discount to the prevailing market price, so much so that various Bitcoin miners are publicly listed and available for purchase in traditional retirement funds. But while investing in Bitcoin miners can carry the same volatility and risks as Bitcoin itself, they could outperform the cryptocurrency in the long term.

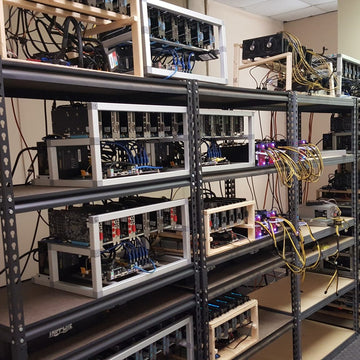

Here are important reasons why you should own a mining rig (in other words, becoming a Bitcoin miner) instead of just buying up Bitcoin.

They Help You Acquire Cryptocurrency Faster

Bitcoin mining companies have a much lower cost per Bitcoin when compared to individual miners. This is due to their economies of scale and their specialized equipment. The miners are getting a big discount on their power, which allows them to mint Bitcoin at much lower prices than the present market rate.

The 19.07 million Bitcoin that are currently outstanding were mined by the miners of today, who are continuously competing for a larger share of the remaining 1.91 million Bitcoin that have yet to be mined. The total Bitcoin supply will only be 21 million, so the competition among miners will likely continue until all of the Bitcoin has been mined.

Public Bitcoin Companies Keep Amassing, Not Selling

Many companies in the Bitcoin mining industry have decided to hold onto all the Bitcoin they mine rather than sell it. This has led to these companies having large amounts of Bitcoin on their balance sheets.

Because of this, the stock prices of these companies are now closely tied to the price of Bitcoin.

This could potentially mean that investing in Bitcoin mining companies could be more profitable

in the long run than simply investing in Bitcoin itself.

Another consideration when investing in Bitcoin mining companies is whether or not the

company sells all the Bitcoin it mines daily. Some companies hold onto their Bitcoin, while

others sell it immediately. This could be an important factor to consider when making investment

decisions. Thus, if you want to add more cryptocurrency to your portfolio, it’s better to be a

Bitcoin miner.

Bitcoin Mining Is Just Like Payment Processing

Investors who put money into bitcoin mining companies will profit from the fees paid by users

who transact using bitcoin. As the number of people transacting with cryptocurrency grows, so

will the fees paid to miners, providing a tailwind for these companies.

Therefore, if the number of Bitcoin transactions increases, the fees paid to the miners who

validate the network will also increase. This could eventually become a significant source of

revenue for miners, although it is not a major part of their income. Investors who put money into

companies that mine Bitcoin may benefit from this trend.

Summary

When investing in Bitcoin, it's important to remember that owning the actual cryptocurrency

offers benefits that other options, like trading, can't provide. In other words, investors realize

greater profits over the long term by going directly to Bitcoin miners instead of simply holding

Bitcoin.

Invest with August Mining Inc. Today

Become a Bitcoin miner today with August Mining Inc.! We provide the best-of-class solutions to everyone interested in cryptocurrency. Visit our website and shop for your mining rig now!